What are the chances of AMD in the server market? Expert opinion and Analytics

This article is the first in a series of analytical reviews devoted to AMD's server strategy, its processors, technologies, and the overall server ecosystem»

"EPYC" History

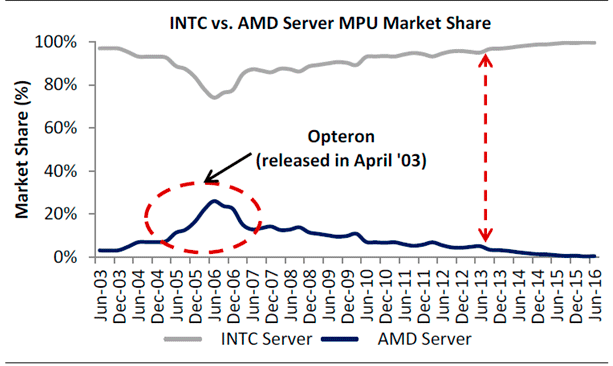

Since the introduction of AMD EPYC 7001 series processors in 2017, AMD’s server share has grown from 0.5 percent to 2.9 percent: taking into account the “low base” effect, this result is difficult to consider noticeable.

Therefore, AMD is pinning its hopes on the second generation of processors for single-and dual-socket x86 servers, announced August 7, 2019. Enthusiastic reviews and benchmark results of the new EPYC 7002 series make us recall the success of the AMD Opteron server processor, which allowed the Corporation to achieve in 2006 a little more than 26% of the total turnover of the x86 server market. AMD’s technological leadership in those years was well recognized by the industry, so it is rational to draw certain historical parallels, to compare the old and modern AMD strategy against the background of changing market conditions and models of server use.

The Opteron processor was introduced in April 2003, before its desktop version of the Athlon 64. In the process of entering the market of commercial applications AMD had to overcome new challenges. As today, the mass corporate customer was not ready to switch to an alternative processor supplier. The company literally “breaks-in” through fear of the server manufacturers to lose marketing funds and access to technological samples and documentation Intel and dumped the concerns of customers associated with the absence of AMD the reputation of the manufacturer of server processors. The company began to conquer the market with the supercomputer segment, where technically competent agnostics to this day prefer to use the most advanced and productive processors. In 2003-2005, first national computing centers, and then the largest corporations deployed computing clusters based on AMD Opteron.

The fault of the mass market’s unavailability was not only the traditional thinking and fears of migration to a new microarchitecture, fueled by nonsense like the “Hotness” of processors. The lack of certification for a variety of professional applications, the limited choice of the first server models, compilation and optimization tools, rare success stories and many Intel employees who regularly visited customers and manufacturers in all developed countries of the world, make the history of the Opteron processor absolutely legendary.

Among the factors that contributed to the success, it is worth highlighting the five most influential:

- Significant performance advantage of the K8 architecture and its later dual-core version until mid-2006;

- Advanced topology of direct connections of processors on the basis of HyperTransport interface, providing performance advantage (growing with the growth of the number of sockets) from 2 and 4 socket systems based on Intel Xeon;

- Ease of implementation of the x86-64 instruction set (AMD64), which expanded address spaces without the huge costs of application migration and purchase of new systems based on Itanium CPU, plus the subsequent actual announcement of AMD64 support from Intel;

- Thanks to direct interaction with AMD’s sales team, 25 percent of the world’s largest fortune 100 customers used Opteron in 2004, including for traditional business applications.

- A wave of mass announcement of Opteron-based servers by A-brands in 2004-2006: global manufacturers were less afraid of Intel’s reaction. The number of clients among global companies of the Forbes Global 2000 list increased, the competition positively affected the prices of microprocessors, all market participants “got into taste”.

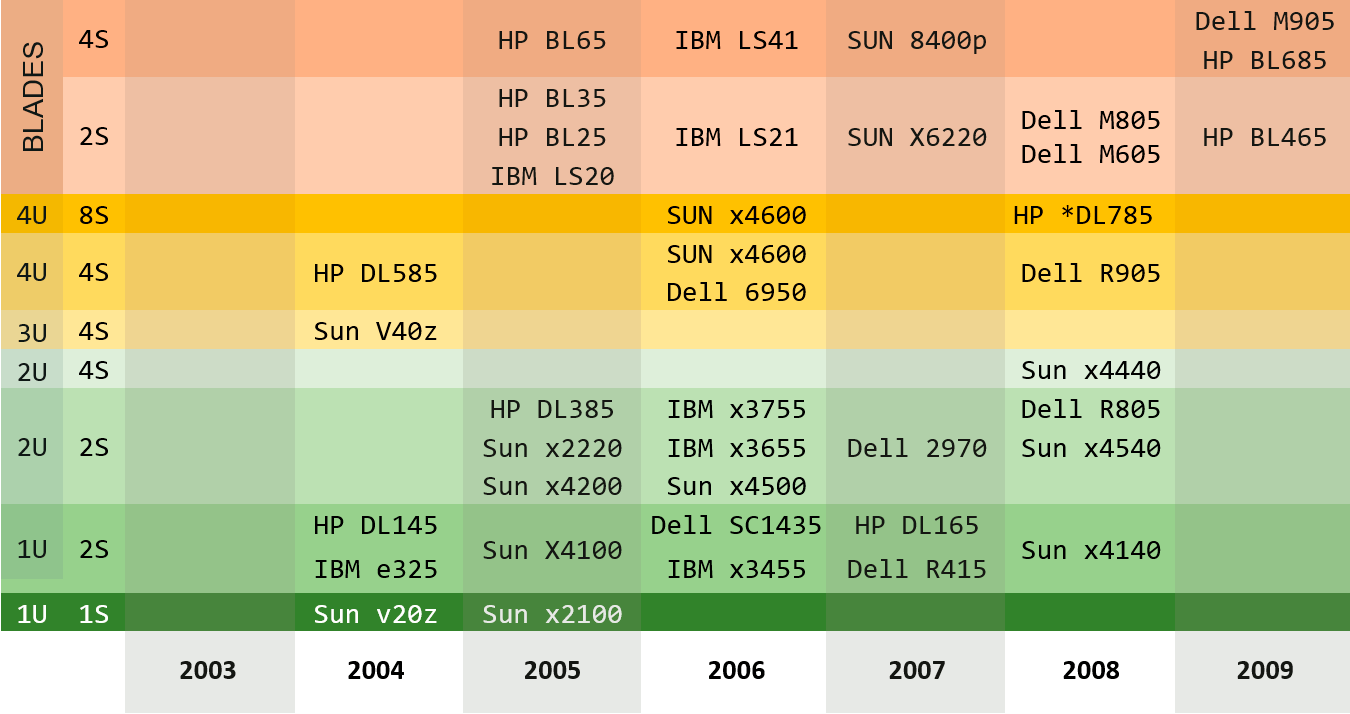

IBM was the first global manufacturer to test the response of the market by launching the x325 dual-socket Opteron system in early 2004 to build high-performance clusters. IBM has successfully promoted a wide range of RISC - and x86-servers and not particularly sought to disrupt the existing positioning of its servers based on Intel Xeon. Unlike IBM, Sun Microsystems, which historically focused on the SPARC architecture, was under pressure from the dynamically growing market for x86 applications, where its few Xeon systems were almost not sold.

Shortly after IBM Sun launched a couple of trial systems on Opteron and in 2005 made a strategic bet on a new line of Galaxy-based CPU Opteron. Galaxy was developed by Sun co-founder Andy Bechtolsheim (Andy Bechtolsheim), who returned to the company together with his start-up Kealia, engaged in the development of systems for the Opteron since 2001. Bechtolsheim is considered a brilliant engineer and a successful technology investor, and 59 people his startup at the time was the largest and most experienced team of developers outside of AMD.

At the same time, within Sun there was a certain resistance of sellers of large systems SunFire, not particularly interested in the new, relatively low-margin business. The company had to create a separate Department dealing with sales of new systems.

Almost simultaneously with the Sun began to show interest and HP. In 2004, they already realized that AMD’s “64 bits for the people” would be an obstacle to the success of Intel-created Itanium processors and HP Superdome systems based on them. Soon representatives of the company came to AMD to discuss the use of both desktop and server chips AMD in the line of their products. HP has become the third global OEM-om, supported Opteron. Despite the negative reaction of the division that promoted Itanium, HP launched two - and four - socket rack servers and blades on Opteron, which quickly became the engine of corporate sales of Opteron. After evaluating the benefits of HyperTransport technology and AMD multi-core processors, HP recommended DL585 eight-core servers and bl65 blades for AMD to customers, and even established mandatory individual sales plans for these systems.

By 2006, Opteron was actively used in a wide range of applications from web servers, terminal applications and databases to high-frequency trading and the increasingly popular virtualization based on VMWare hypervisors. And the backbone of sales was formed by demand from the largest American and European companies. The company quickly conquered the corporate market, Internet service providers and national laboratories, while its success in the segment of small and medium-sized businesses was modest.

Sun Microsystems, the share of AMD systems which reached 40 percent of all x86-systems, even launched a unique eight-processor galaxy server on Opteron in 4U version (only three companies in the world made eight-processor designs: Sun, HP, Iwill). In the server blade segment, IBM and HP were the leaders with two - and four-socket Opteron configurations.

In order not to lose its share in the market, SuperMicro (which, strictly speaking, is not A brand, but is popular both in the segment of computing clusters and among national OEMs) without unnecessary hype launched several server boards and platforms on AMD Opteron in 2006.

Dell has long kept “on the sidelines”, and began with 1U server for clusters in 2006, then quietly launched a dual-processor system, and only in 2008 publicly presented an expanded server portfolio based on AMD Opteron. Evil tongues claim that in addition to the pressure of corporate customers, the launch of a full line of servers was dictated by the risk of accusations of cartel with Intel. In fairness, it should be noted the excellent functionality of two-and four-socket servers and blades based on multi-core Opteron, presented in 2008-2009 in the style of servers of 11G generation. Launched at a Mature stage of the Opteron lifecycle, the sales of these Dell servers were passive, and the demand structure almost completely shifted again in favor of solutions based on Intel Xeon.

Let’s illustrate the previous paragraphs with a list of rack servers on Opteron:

Picture 1. Rack systems of global OEM manufacturers based on the AMV Opteron CPU in 2003-2010 (sockets 940 and A)

[in order not to clutter the material, updates and decommissioning of servers are not specified.]

Thus, 2006 was the peak of AMD’s server achievements: recognizing the dead-end direction of products based on the Pentium 4 microarchitecture, Intel announced the Xeon 5100 “Woodcrest” based on the new core microarchitecture, originally intended exclusively for mobile applications. Starting with the announcement of " Woodcrest” in mid-2006, Intel began to dynamically regain its legitimate market share (image 2).

AMD did not have a product corresponding to the core potential and later Nehalem. Neither the increase in the number of cores nor the scalable platform saved us. In 2011, despite the release of the new Opteron processor on the Bulldozer microarchitecture, OEMs gradually began to curtail the production of the above servers. As a result, as mentioned at the beginning of the article, by 2017 AMD’s share was half a percent of the server market. This was the dramatic result of the stunning history of the brand AMD Opteron.

Picture 2. Dynamics of the ratio of Intel and AMD shares in the x86 server market. (based on analytical data from Mercury Research, GII and Stingy Suisse.)

According to the management of AMD, in 2012 it was decided not just the question of what will be the next processor for the server segment. It was about the General expediency of any further attempts to return to the server market. It was a strategic decision to create a new processor from scratch, without trying to revive the microarchitecture Bulldozer. Given the resources incommensurable with the capabilities of Intel, to repeat the success of Opteron AMD must again accurately “enter the market”. This requires knowledge of the current situation in the server market, understanding its evolution over a decade and a half, and taking into account many factors.

Evolution of the server market

Over the past fifteen years, the server market has undergone significant changes. First, there is a consolidation of server suppliers: the share of local collectors and national producers, who lost the power of brands of the first and second echelons, decreased. The degradation of the “resellers” business has forced small builders to either reorient to the sale and maintenance of A-brand products, or go into adjacent niches. Distributors compensated for the reduction in sales of server components by offering ready-made systems and gadgets.

Second, customer needs have changed. Fifteen years ago, each company had a small but its own it infrastructure and system administrator. With the emergence of an extensive market for cloud services, this is not necessary. Enough access to the Internet and personalok for employees, everything else will be implemented “in the cloud”. Large companies are increasingly using hybrid clouds. And new startups in the US generally reject the classic purchase of equipment, allowing and encouraging employees to use personal devices (BYOD – Bring Your Own Device) at work.

Third, the overall market situation has changed: virtualization technologies and containers lead to the transformation of it products from product to service. Solution providers are transformed into service providers, setting up their own data centers, raising private “clouds”, etc.

This led to the consolidation of buyers: the largest buyers of servers have become aggregators – owners of data centers (hyperscale), in which many customers now simply leases the equipment, virtual infrastructure and ready-made services. According to AMD (next Horizon presentation in November 2018), a decade ago, the ten largest server buyers created less than 10% of total demand. Today, the TOP 7 buyers create up to 40% of the total demand. At the same time, the global volume of the server market continues to grow.

Examples of hyperkahler: Amazon, Alibaba, Baidu, Facebook, Google, Microsoft, Yahoo. They are providers of the now familiar cloud services: available worldwide mail, social networks, cloud storage, which allowed to abandon the local storage of many types of information.

The canons of building a fault-tolerant architecture have evolved: “it as a service” is initially designed as a distributed system that can dynamically scale the load, and transfer it from faulty equipment to serviceable on almost any scale. Local redundancy is replaced by dynamic load distribution, the mass of sockets inside one server (Scale Up) - by the mass of peer servers (scale out).

Hyperscale considered disadvantageous to the purchase of expensive standard servers from leading Uemov, and began to buy directly from a major ODM-s, such as Quanta (QCT) and Inventec, stands ready with a custom server configurations.

Further – more. Facebook and other players have started to create their own standards Open Compute Project (OCP), OpenRack, etc… The industry focused on deployment automation, density, efficient power and heat dissipation, server security, software implementation of network systems and data storage based on standard servers, the use of heterogeneous computing, as well as the allocation of independent computing, network and storage pools. Hyperskilers have become a new type of the largest consumers of server microprocessors and the driving force of the industry, with component suppliers, OEMs and ODM manufacturers battling for their orders.

Thus, the strategy of the new AMD server product release should take into account both the realities of the modern server market and historical lessons:

- Servers are moving inexorably from a vertical to a horizontal scale, the “bricks” of building a modern system with distributed loading is considerably different from the systems of a decade ago;

- Hyperscale become the largest consumer of server technologies;

- Cloud, virtualization, and hosting have turned it into a competitive service for customers;

- The high-performance computing market continues to grow and is complemented by computing clouds;

- The share of national OEM producers has significantly decreased, and local companies-manufacturers have gone to the adjacent spheres;

- The remaining manufacturers and integrators are building their data centers to provide it services to customers;

- OEM manufacturers are ready to supply new solutions, but expect direct, active work with customers from processor manufacturers to generate demand for such systems;

- AMD’s financial and human resources will be enough to provide quality service to the needs and support of only the largest customers.

The following Chapter will provide an analysis of the successes and failures since AMD processors EPYC 7001. All three chapters should allow us to approach the strategic assessment of the prospects of the new EPYC 7002 series in the next year or two and move to a substantive analysis of the technologies and main applications of the new AMD product.

To be continued

Victor Kartunov

20/08.2019